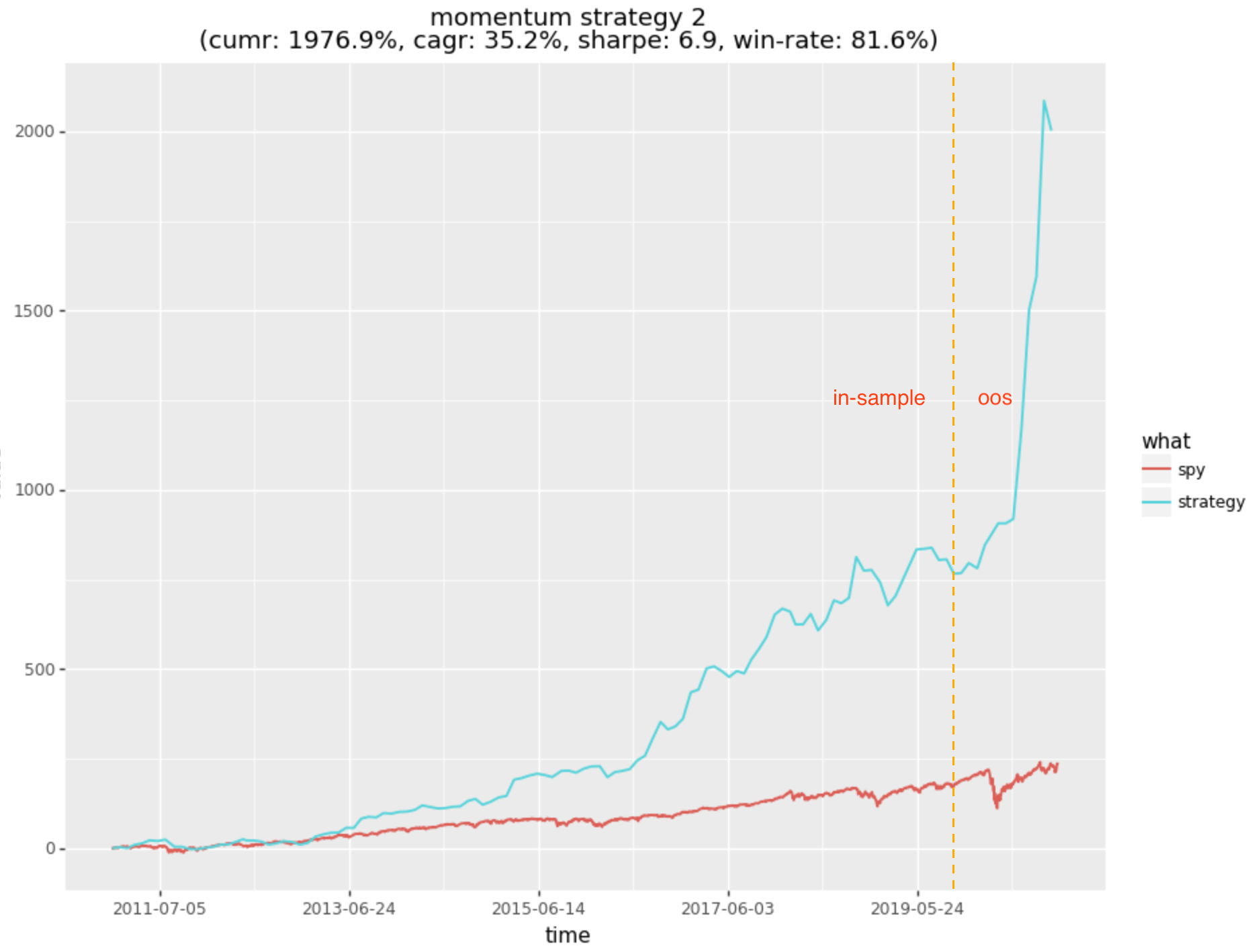

New Equities Strategy (p2)

In the prior post I showed results for a new equities strategy which uses a combination of signals to create and risk manage a high-momentum portfolio. Further investigation revealed that I had neglected on a couple of fronts:

- failed to account for dividends (which are substantial)

- some data issues

- improper sharpe calculation

The good news is that solving these issues substantially improved the profitability of the strategy (which was already high return for a low-freq strategy).

The strategy invests in a portfolio of stocks from period to period. Some of these stocks will underperform or experience unrealized drawdowns during the holding period. I spent some time trying to determine if there was a way to detect a losing asset and cut it earlier to reduce impact on the portfolio return. Many profitable stocks see a small negative unrealized drawdown during the holding period:

| unrealized drawdown | % | % with positive outcomes |

|---|---|---|

| all | 100% | 65% |

| touched < 0 | 72% | 52% |

| touched < -2% | 55% | 41% |

| touched < -5% | 33% | 22% |

| touched < -10% | 14% | 4% |

Note that overall, in spite of 72% of assets touching a negative unrealized drawdown during the holding period, the combined return of the portfolio over each period was positive 81.6% of the time. Looking at the above table one might decide to cut assets that touch the -5% level, however this produces lower P&L for the following reasons:

- mean reversion of price during holding period (to more positive outcome)

- loss of right tail on the 22%

A money-management approach that is effective, is to condition on:

- negative return (-5% for example)

- buy/sell imbalance as a measure of negative momentum

- target mean-reversion of at least 50% of the unrealized loss

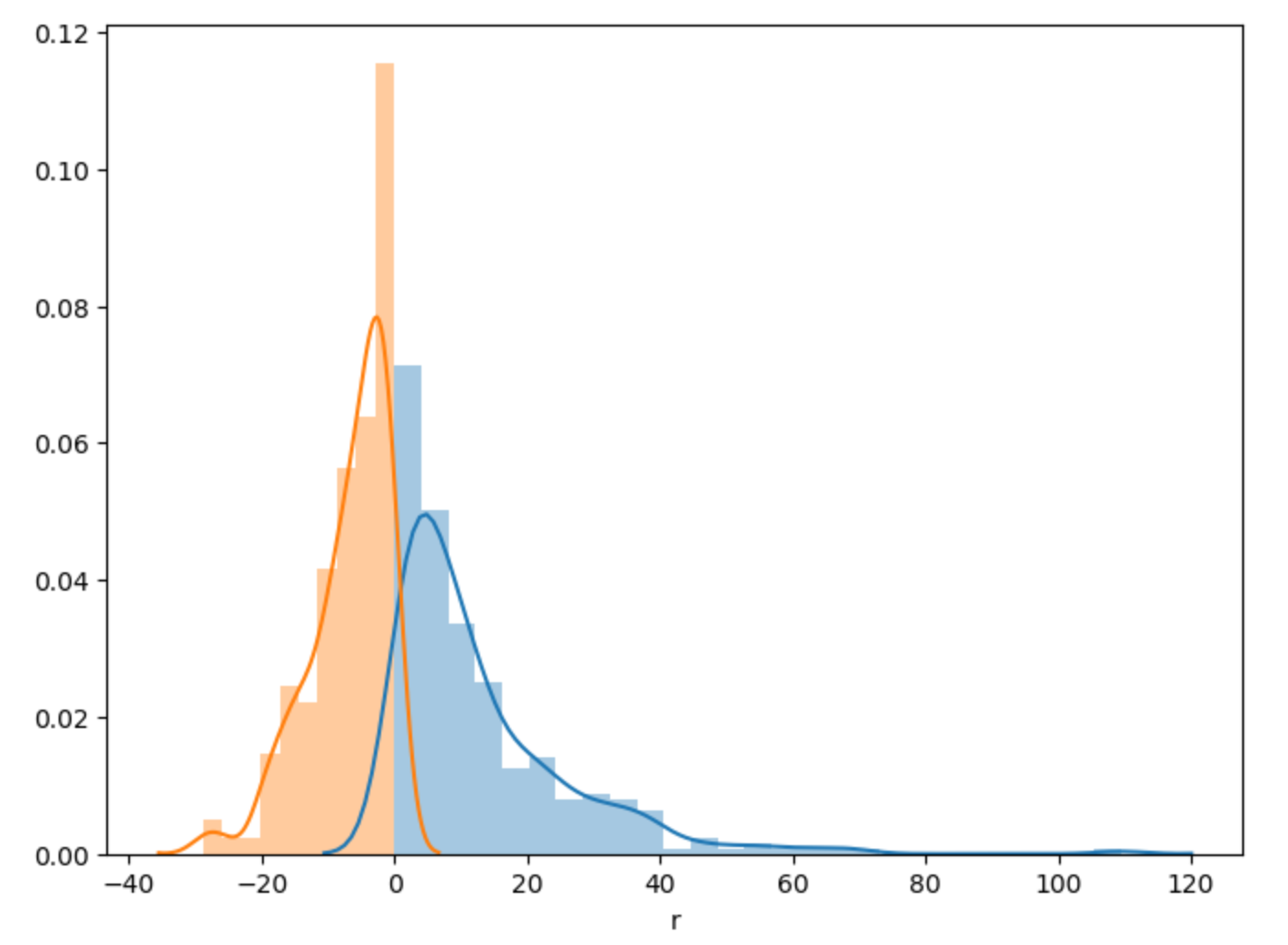

However, this only improved the strategy by 48% over the 9.75 yr period, and as I was concerned with avoiding data-mining bias, so did not include in this round. One reason why leaving drawdowns unadjusted is favorable is that this strategy has very strong right tails:

The above is the realized return distribution for individual assets during their holding periods.

Other notes

The strategy was able to take advantage of the 2020 market drawdown, an unusual circumstance. Without the drawdown, the prior period CAGR would be ~30% instead of 35%. I would expect a trajectory similar to 2019 going forward now that the market has snapped back.

Next Steps

At this point have solved some important issues with the strategy and backtest. I am starting to trade this manually, however, I need to get this up and running systematically. Status of work to be done:

- Strategy (complete for backtesting)

- May need some adjustments for live execution

- Strategy and strategy framework written in Kotlin, research done in Python (and in the past R).

- Data Feed (only historical currently, need live)

- I am curently using Polygon.io for historical data, though have had to mix in data from other sources due to a few stocks (out of 1700) missing back history or with data issues

- Splits & Dividend information have been a combination of Polygon.io, Yahoo, and other sources. I run a reconciliation to arrive at correct information. In some cases I have to manually edit my meta data. Hopefully find a reliable single source for this. Polygon is working on improving their equities meta data, but is a work in progress.

- Execution (partially implemented)

- I am not running AUM on this, rather just my own money. The most economical options are the low-cost brokers that service the retail community. Alpaca has the best API of the lot. Other alternatives would be TD, e*trade, or IB.

- Alternatives: While TD is a large broker, their API is not streaming and their support around the API reputed to be poor. IB has a well known API, but is very difficult to work with and has significant limitations (from experience).

- Monitoring / UI (not started)

- I am quite familiar with R/shiny as a way to quickly put up a UI for monitoring & controls. However I prefer Python over R. Dash is far less mature, but may attempt to put something together with it.

While trading retail may make sense for a period, for tax reasons it may make sense to trade this out of a different structure. I need to understand the various ways I can set this up. I want to avoid paying short-term capital gains and be able to reinvest most of the pre-tax principal YoY.