Uniswap v3 & Liquidity Provision

I had a look at Uniswap’s upcoming V3 protocol overview and white paper. There are some substantial improvements above the current V2, such as:

- ability to offer “concentrated” liquidity (we’ll discuss this below)

- ability to introduce pools with varying fee structure

- advances in oracle efficiency and new oracle types

- ..

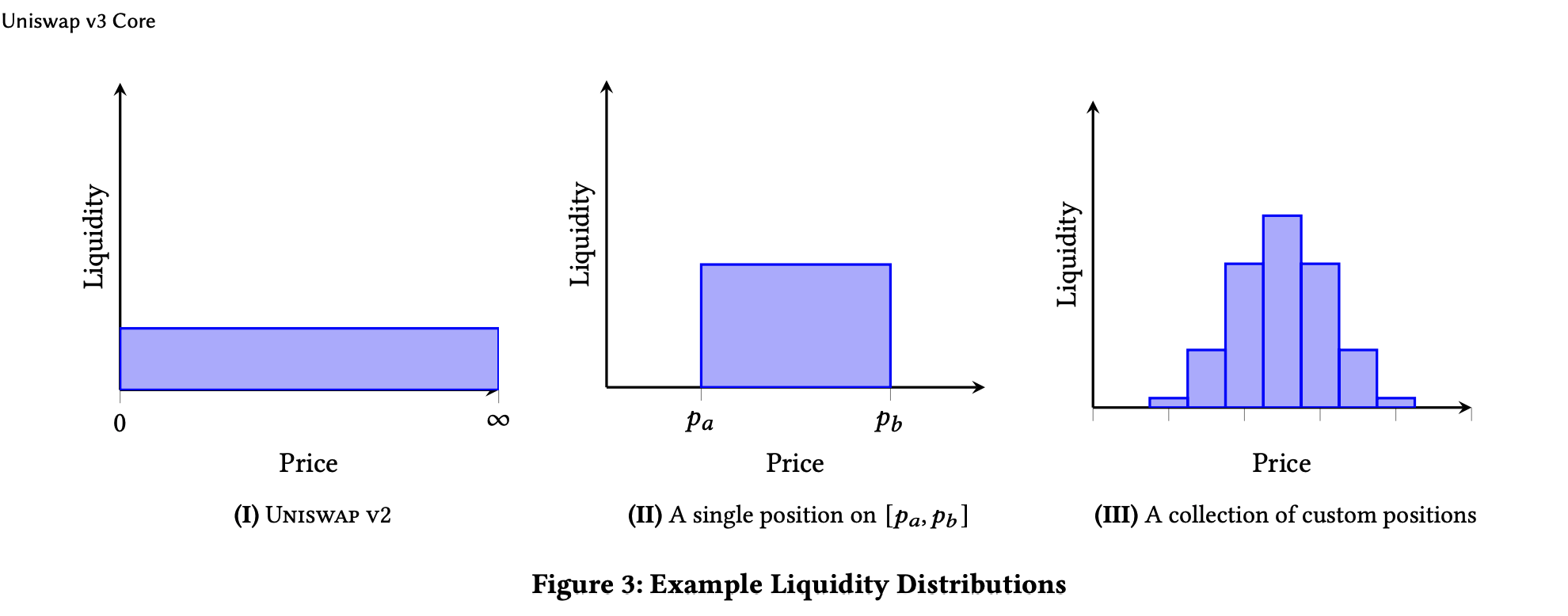

For a market maker, the most important of these is the ability to “concentrate” liquidity. What does this mean? As of V2, one’s liquidity was uniformly distributed across all price levels, as opposed to being distributed near the prevailing price. In limit-order book terms, this would be equivalent to offering 1/k coins at each price level (given a maximum of K price levels). This is very capital inefficient as most trading occurs near the prevailing market price.

Here is a diagram from the whitepaper illustrating the liquidity allocation of V2 versus possible distributions of liquidity in the uniswap V3 pool:

In V3, through the use of range position contracts, one can effect any distribution of liquidity desired.

Problems

Being able to center liquidity around the mid price (or whatever price is advantageous for inventory) is an indispensable tool for market makers (and yield farmers for that matter). However as nice as this seems on the surface, has some significant issues:

- transactions in the ethereum blockchain take 10 - 20 minutes to transact

- gas fees are expensive and progressing higher due to the large # of ERC tokens on Ethereum

A traditional market maker will adjust orders (liquidity positions) at high frequency to remain competitive and keep liquidity near the prevailing market price. With a transaction overhead on the Ethereum blockchain measured in 10 - 20 minutes, would require the market maker to spread liquidity across a wider price range in order to maintain participation in the market, diluting capital efficiency and incurring more risk.

The second issue relates to cost. Centralized exchange, both traditional and crypto, do not charge fees for order placement. The gas fees inherent in updating the liquidity position range on Uniswap would be prohibitive for traditional market making.

A Solution: Pegged Liquidity Contract

Uniswap should introduce a Pegged Liquidity order (contract). The contract would indicate the following:

- allocate K coins according to some distribution relative to the prevailing price

- express the distribution as:

- x coins at level price +/- offset1

- y coins at level price +/- offset2

- …

- up to a sum of K coins

- limit the lowest (highest) price will offer on

- this avoids following the price in a flash crash or just some level below which the market maker considers uneconomical

As the prevailing market price moves (as determined by the oracle), the liquidity automatically moves with the price. This will allow the market maker to participate in as many transactions as possible without having to issue a new directive on the chain to move the liquidity position when the market moves. This avoids both the ultra-high latency (10 - 20mins) and the costs (gas) of moving the liquidity to meet the price.

One can imagine other variations of this where the liquidity positioning only changes when the price increments by more than k%, keeping the liquidity/price offering constant for smaller moves.

The proposed contract solves some of the concentration problem, however, it cannot go as far in offering the granularity of control that is possible with centralized order books. With a faster and cheaper blockchain we can start approaching the efficiency of a central LOB.

Future of Uniswap

Uniswap’s Achilles heel is that it is based on the Ethereum blockchain. This has served it well until recently as many of the coins traded on Uniswap are ERC-20 tokens, avoiding the need for Ethereum-transplanted proxy coins. However, Ethereum presents substantial problems for a DEX:

- non-deterministic transactions (required K blocks to verify transaction, much like bitcoin)

- by non-deterministic mean that addition of a transaction to a block does not guarantee the transaction; rather the transaction can only be assured after a certain number of blocks are added on the branch with the transaction.

- this increases latency substantially

- scalability concerns (perhaps mitigated with side-chains)

- however side-chains are not the most elegant solution and may present new attack vectors

- high costs (gas fees)

The future for DEFI / DEX’s is likely to be on one of the newer blockchains, ones that:

- provide atomic transactions (ideally)

- higher scalability

- lower transaction costs

- interop with other chains

In this regard, Cosmos looks quite attractive. There are other blockchains and DEFI projects in competition for the DEFI space (I will not enumerate them here). The Ethereum Blockchain is innovating quickly (unlike the Bitcoin chain). The momentum and the early lead of the Ethereum ecosystem could still win out in the end, in spite of the attractive properties of these newer chains.

Perhaps, though, the answer is not one L1 chain technology, but rather the projects that allow an inter-net of block chains - allow multiple chains to coexist and seemlessly interoperate. Cosmos is playing in this direction.